With all the hype surrounding electric vehicles (EVs), especially the lithium-ion batteries that power them, it’s easy to get the misconception that these batteries are made mostly of lithium.

The truth is, though, that they only have a tiny percentage of lithium. The main metal in these powerhouses is actually cobalt. So, while everyone’s been in an uproar over lithium investments, cobalt has gone mostly under the radar — even while it’s the most important part of those batteries… and while demand has been skyrocketing.

Cobalt is essential for producing lithium-ion batteries, but it’s a really tough metal to get to.

Cobalt can’t be mined directly. In fact, no native cobalt has ever been found on Earth. Instead, it’s a by-product of copper and nickel mining. And it’s only produced in a few places in the world — one of which is literally a perpetual war zone…

Blood Batteries

You see, most of the world’s cobalt comes from the Democratic Republic of Congo (DRC). The region produces 46% more cobalt than the other top nine countries combined…

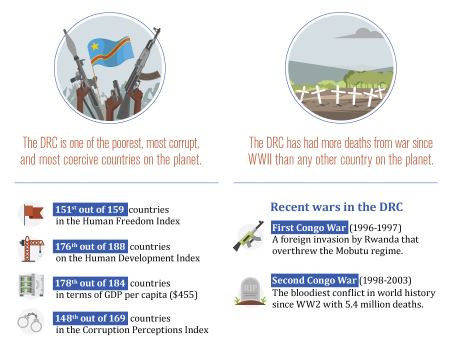

And in case you didn’t know, the DRC is neither of those things — it’s not democratic, and it’s certainly not a republic. The DRC is, in fact, a veritable war zone with rival leaders constantly struggling to rip power from the hands of their opposition.

And the people of the DRC are caught in the middle.

I’m sure you’ve heard of “blood diamonds.” They’re the diamonds that come from war-torn areas in Africa. Their sales go to finance warlords and the rape, murder, and general brutalization of civilian populations in the areas.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

But we may be hearing about blood batteries soon…

That’s because, as the demand for cobalt has outstripped the supply, prices are skyrocketing.

And the warring factions are realizing they can fund their terror campaigns with cobalt. It’s much easier to sell than diamonds, since you rarely hear folks asking their Tesla dealer or Apple store if the battery in their product cost someone their arm.

That’s part of the reason Elon Musk has promised to source the supplies for his Gigafactory from North America. He knows someone’s going to make the link between cobalt from the DRC and his cars. And he’s not trying to have that blood on his hands.

Limited Supply, Massive Demand

This is where we get to the title of the article. There’s not a ton of cobalt production here in North America. And Elon Musk has promised to source all the cobalt for his batteries from North America.

As you can see from the table above, Canada is the only country that makes the top 10 list. There are a few companies there producing the material, but they only produce a combined 7,300 MT a year so far.

Just to put that into perspective, each Tesla Powerwall 2 has 7 kg of cobalt in it. And each Model S P90D battery has 22.5 kg of the metal.

That might not seem like a lot, but when you multiply those numbers by the number of Powerwalls and P90D batteries that one Gigafactory can produce, the numbers become staggering.

To meet Musk’s prediction of producing enough power cells for the equivalent of 500,000 cars by 2020, one Gigafactory will need over 11,000 tons of cobalt — more than all of Canada produces now.

And while most of the world’s cobalt still comes from the DRC, mining companies have stepped up their focus on Canada. In fact, out of the four potential sources for the cobalt of the future, three of them are in our neighbor to the north.

But it takes a while to get a mining operation underway. So, Musk has extremely limited choices right now when it comes to where he’s going to get his cobalt.

And my colleague, Keith Kohl, has his sights set on a little-known company right here in the States. What’s best is that this company operates right next to Tesla’s new Gigafactory. That makes shipping costs practically nothing — and far cheaper than getting it from Canada’s faraway territories.

This company still trades for around one dollar a share, but there’s nothing stopping it from skyrocketing above $15 in short order. As soon as Musk starts buying up all that cobalt — at extremely high prices — investors are going to pile in.

But, thanks to Keith and his tireless research, you’ve got the opportunity to get in before anyone else even knows about this little gem.

He’s put together a presentation explaining the opportunity. And I highly recommend you take some time to check it out. But if you’d prefer to read the transcript, you can click here.

Either way you do it, you need to pay attention to what Keith has to say. He’s already led readers to massive gains in the oil and mining industries. And this company could make all those triple-digit wins pale in comparison.

So, I implore you to listen to Keith. You and your portfolio won’t regret it.

To investing with integrity,

Jason Williams

Energy and Capital

Follow me on Twitter @AllBeingsEqual